9 days to lift the American protection for the money .. and government hedge Baghdad – The joy of pumice is still Iraq’s debts inherited from the misguided policies of the regime dictatorial, a burden on successive governments since 2003, and until now, but the efforts of those in charge of running this file may bear fruit in the form of stages over the coming years, especially as the government prepares to face the new challenge is to lift protection for Iraqi funds abroad after 9 days only, so put mechanisms in collaboration with several sides to face any risk of legal or financial that may arise.

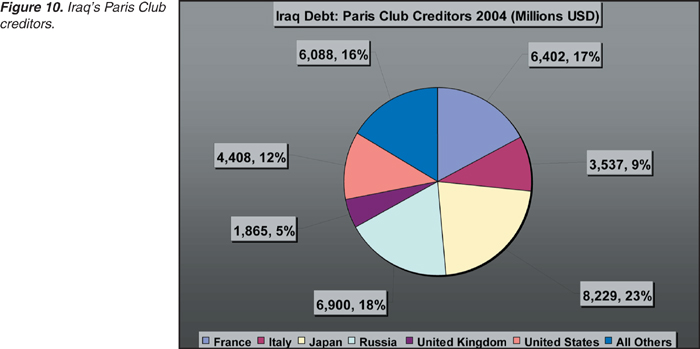

Tackle debt and to clarify the issue of debt The Director of the Department of Legal Relations in the Ministry of Finance Mohammad al-Saadi “morning”, saying that “Iraq’s debt before and after the year 1990 are two sovereign and commercial,” calling to speed up the processing with near lift protection for Iraqi money in 22 of the current month. between al-Saadi, , who warned of the book on the Iraqi funds by the creditors, it is, “according to the Paris Club agreement has reduced Iraq’s debt to 80 percent of their value in agreement with the creditors, but it is according to the law, the benefits of international financial assets amounts to an ongoing Iraq was born weighing new indebtedness the shoulders of the state, “and points out that the debt is divided into three phases since 2004 and until 2028, which is binding on the Iraqi side only, and added indebtedness new surpass the previous accumulation of interest, pointing out that the figures are not accurate because it is on the increase and constitute a current debt of nearly 4 billions of dollars for corporate debt declared.

Was due to end Iraq’s debts in the year 2028 according to (scheduling and restructuring of Iraq’s debts of Foreign Affairs), according to Saadi. principal and in this regard, confirms al-Saadi to buy the debt came under the international resolutions, the UN Security Council which represents the principal amount plus interest , and the estimated value of 10.25 percent of the original of this for the debts of foreign private sector (commercial debt), which is binding on the Iraqi side and a non-binding for foreign companies the right to rejection and acceptance, either sovereign debt are purchased worth 20 percent of the origin of religion. new proposals for the proposed Saadi Several proposals contribute to extinguish the debt be fruitful for both parties (creditor and the debtor.) and adds that the “first suggested is to give productive investment in Iraq in exchange for ceding his religion and dropping the suit, with includes the second to give the oil Black (remnants of crude oil) in exchange for canceling the debt, while states third proposal to hold a bilateral agreement with the owner of the debt by giving the value of the interest estimated at 10.25 and giving out the amount and Tksath over 10 years.

” Revealed Saadi on “submit these proposals to the Minister of Finance in order to put in the General Secretariat of the Council of Ministers,” Hada on “the formation of high-level delegation of the agreement with the Secretariat of the Paris Club to discuss these proposals, if approved by the Council of Ministers. ” protection money either financial expert, the appearance of Mohammed Saleh, has pointed out that Iraq’s money deposited in the account receipts which Fund (DFI) with the Federal Reserve Bank of New York, and thus are protected about it U.S. presidential. between Saleh in a statement the “morning” that Iraq demanded in the past year to extend the period of protection on his money, which is due to expire on 22 May this year, and wondered, saying: “Is that Iraqi funds are protected in nature or not. ? We can not predict the risk of legal.

” He continued: “In general, the fact that these funds are open calculates the Central Bank of Iraq for the benefit of the Iraqi government, so they are protected by the Federal Reserve Bank, which is a branch of the Central Bank of the U.S., especially as the central banks protect the money some of them, not especially if the money the central bank independent, not a money business and contribute to economic stability. except that Saleh pointed to the possibility that pursuing Iraq’s money when you lift protection by the creditors of the private sector, because governments do not sue other governments. no risk , however emphasizes that this debt does not pose a threat to Iraq, especially that creditors number is limited and some of them won a judgment lien on Iraqi funds, as in the case of Kuwait Airways a few years ago.

According to Saleh, Iraq is only debts worth 21 billion dollars, adding that the debt is divided into two forms small and large means that the value of the debt has become 10.25 percent, out of the amount. “The small debts that make up the 35 billion dollars and more than 4 and a half billion dollars paid Iraq immediately and in cash at 10 and a quarter of its value, ie, approximately 89 percent, according to the Convention on the club Paris, called the current value of the present, ie, that the five billion became $ 450 million (shot on Iraq), while the more than 35 billion dollars were accepted bonds Iraqi Bdjunhm 20 percent of its value for the year 2028 valued at an interest rate of 5.8 percent.

Vulnerable places , however, confirms the benefit of that care to state funds is an urgent need and at the same time it is necessary to take risks and to defend the money, so called for the formation of an ad hoc committee of legal experts and financial to connect to a network of international lawyers to defend the interests of the state in every place, a proposal also put money in places fortified non-judicial reservation on any state or government institutions when opening accounts abroad to be sure, including whether the vulnerable and not subject to judicial reservation.

alsabaah.iq

No Comment Yet